How to Calculate Customer Lifetime Value

At its core, calculating customer lifetime value is pretty straightforward. You just multiply your average customer value by the average customer lifespan.

This simple formula gives you a quick snapshot of the total revenue you can reasonably expect from a single customer over their entire relationship with you. It’s a powerful way to turn a complex, ongoing relationship into a tangible number you can actually use. While it's a basic calculation, it's the perfect starting point for making much smarter strategic decisions.

Why Customer Lifetime Value Is a Business Game Changer

Before you even think about opening up a spreadsheet, it's crucial to grasp that CLV is more than just another metric to track. It's a strategic lens that can completely reframe how you think about growth. It forces a shift in focus from chasing short-term sales to nurturing the long-term health of your customer relationships.

Understanding your CLV changes how you spend your money and time. Instead of a one-size-fits-all approach, you can pinpoint your most valuable customer segments and invest heavily in keeping them happy. This might mean giving them priority support or creating loyalty programs that truly reward them. It’s about accepting the simple truth that not all revenue is created equal.

Driving Smarter Business Decisions

When you have a solid handle on your CLV, you can start answering some of the toughest business questions with real confidence:

- How much can we really afford to spend to get a new customer? Your CLV sets a hard ceiling on your Customer Acquisition Cost (CAC), making sure your marketing spend is actually profitable.

- Which of our marketing channels are bringing in the best customers? By comparing the CLV of customers from different channels, you can stop guessing and start doubling down on what truly works.

- Where should we focus our retention efforts to get the biggest impact? You can identify high-value customers who might be at risk of leaving and step in before it's too late.

This kind of insight moves you from constantly putting out fires to proactively planning for growth. It’s the difference between guessing what your customers are worth and knowing exactly what their loyalty means for your bottom line.

CLV isn’t just a report card on past performance; it’s a predictive tool that helps you build a more resilient, profitable business by investing in the right relationships.

The Foundational CLV Formula

One of the most common and practical ways to calculate CLV is using a historical model: CLV = (Average Revenue Per Customer × Customer Lifespan) − Total Costs to Serve.

Let’s run a quick example. Say a customer spends $10,000 with you every year, and they stick around for five years. Their gross CLV is $50,000. But if it costs you $15,000 in support, service, and other expenses to keep them over that period, their net CLV is actually $35,000.

This method works especially well for businesses with fairly stable pricing and predictable customer behavior. For a deeper dive into different calculation methods, check out these insights on CLV from Salesforce.

Gathering the Right Data for an Accurate CLV

Any CLV calculation is only as good as the data you feed it. Before you even think about plugging numbers into a formula, you need a rock-solid data foundation. The old saying "garbage in, garbage out" is especially true here, and bad data can lead you to make some seriously expensive mistakes based on flawed insights.

Think of yourself as a data detective. Your first job is to dig into the tools you're already using every day—your CRM, billing software, and analytics platforms are absolute goldmines. The goal is to pull clean, consistent data that tells the real story of how your customers behave over a specific time, like the last 12 months.

The Core Metrics You Need to Find

To get a handle on a basic historical CLV, you'll need to hunt down three key pieces of information. These aren't just buzzwords; they're the fundamental building blocks for understanding what a customer is truly worth to your business.

- Average Purchase Value (APV): This is simply the average amount a customer spends in a single transaction. Find it by dividing your total revenue for a period by the total number of orders in that same timeframe.

- Purchase Frequency Rate (PFR): This tells you how often a typical customer buys from you. You can calculate it by dividing the total number of orders by the number of unique customers you had.

- Customer Lifespan: This is the average amount of time a customer sticks around and keeps buying. It's pretty straightforward for subscription businesses, but for e-commerce, a good estimate is the average time between a customer's first and last purchase.

Let's say you run an online store selling specialty coffee. Looking at your records, you see $500,000 in revenue from 10,000 orders last year. That gives you an APV of $50. If those orders came from 2,500 unique customers, your PFR would be 4, meaning the average customer ordered four times that year.

The key is to define your time period and stick with it. Whether it's a quarter or a full year, consistency across all your data sources is non-negotiable if you want a calculation you can trust.

Before you start crunching numbers, it's crucial to have a clear picture of what data you need and where to find it. Here’s a quick rundown of the essentials.

Essential Data Points for CLV Calculation

| Metric | How to Calculate It | Common Data Source |

|---|---|---|

| Average Purchase Value (APV) | Total Revenue / Total Number of Orders | Billing Platform (e.g., Stripe, Shopify), CRM |

| Purchase Frequency Rate (PFR) | Total Number of Orders / Total Number of Unique Customers | CRM, E-commerce Platform (e.g., Magento, BigCommerce) |

| Customer Lifespan | Average Time Between First and Last Purchase | Analytics Platform (e.g., Google Analytics), CRM |

| Customer Acquisition Cost (CAC) | Total Sales & Marketing Spend / Number of New Customers Acquired | Ad Platforms (Google Ads, Facebook Ads), Analytics |

| Gross Margin | (Total Revenue - Cost of Goods Sold) / Total Revenue | Accounting Software (e.g., QuickBooks), ERP System |

Having these metrics handy will make the actual calculation process much smoother and ensure your final CLV figure is grounded in reality.

Common Data Collection Mistakes to Avoid

Pulling this data isn't always a clean, straightforward process. I've seen a few common mistakes trip people up time and again.

One of the biggest is failing to filter out outliers. A single, massive wholesale order or a one-time bulk purchase from a non-typical client can completely throw off your Average Purchase Value. This makes your average customer look far more valuable than they actually are, skewing your entire strategy.

Another classic pitfall is having inconsistent tracking across your platforms. It's not uncommon for your Shopify sales data to not quite line up with what you're seeing in Google Analytics if the tracking isn't configured perfectly. Always take a moment to cross-reference your sources. A little time spent cleaning and verifying your data now will save you from making bad decisions based on misleading results down the road.

Simple CLV Calculations Using Historical Data

Let's dive right in with the most straightforward way to figure out what your customers are worth: using the data you already have. This historical approach looks at past customer behavior to give you a solid baseline CLV. It's an immediate snapshot of what a typical customer brings to your business.

The core concept is pretty simple. You just multiply what a customer is worth by how long they stick around.

It all boils down to this classic formula:

CLV = (Average Customer Value) x (Average Customer Lifespan)

The beauty of this formula is its simplicity. You don't need complex predictive models or a data scientist on speed dial. It relies entirely on the hard sales data sitting in your CRM or e-commerce platform. It's the perfect place to start if you want to get a grip on customer profitability without getting lost in the weeds of advanced statistics.

This visual lays out the key pieces of information you'll need to pull together for this calculation.

As you can see, the historical CLV model is built on three pillars of past customer behavior: Purchase Value, Purchase Frequency, and Customer Lifespan.

Breaking Down the Components

To put this formula to work, we first need to figure out the Average Customer Value. This isn't a single number you can just grab from a dashboard; it's calculated from two other key metrics that describe your customers' buying habits.

- Average Purchase Value (APV): This is simply the average amount a customer spends in a single transaction. To find it, just divide your total revenue over a set period (say, one year) by the total number of orders in that same timeframe.

- Average Purchase Frequency (APF): This tells you how often the average customer buys from you. You can calculate it by dividing the total number of orders by the number of unique customers.

With those two figures in hand, calculating the Average Customer Value is easy.

Average Customer Value = Average Purchase Value (APV) x Average Purchase Frequency (APF)

This result gives you a clear picture of what a single customer is worth to you in a typical year.

A Practical Example in Action

Let’s put this into a real-world context. Imagine you run a direct-to-consumer skincare brand. You pull up last year's numbers and find the following:

- Total Revenue: $300,000

- Total Orders: 6,000

- Unique Customers: 2,000

First, let's get the APV: $300,000 / 6,000 orders = $50 per order. Pretty straightforward.

Next up is the APF: 6,000 orders / 2,000 customers = 3 orders per customer over the year.

Now, you can pin down your Average Customer Value: $50 (APV) x 3 (APF) = $150. This means your average customer generates about $150 in revenue each year.

The final piece of the puzzle is the Average Customer Lifespan. For many e-commerce businesses, a reasonable estimate falls somewhere between one and three years. Let’s say your data suggests the average customer stays loyal for 2.5 years.

We can finally calculate the full CLV: $150 (Average Customer Value) x 2.5 years (Lifespan) = $375.

This historical CLV of $375 is a powerful number. It tells you that, on average, every new customer you bring in will generate $375 in revenue throughout their entire relationship with your brand.

This simple calculation is a fantastic jumping-off point. For a deeper dive into the foundational methods, check out this excellent guide on how to calculate CLTV for your business, which covers various formulas and the data you'll need. By starting with this historical model, you can quickly establish a baseline to better inform your marketing spend and retention strategies.

Peeking into the Future: Advanced CLV with Predictive Models

While looking at historical CLV is a great starting point, it has one major flaw—it’s a rearview mirror. It’s built on the assumption that what customers did yesterday is exactly what they’ll do tomorrow. In the real world, customer habits, your pricing, and the market itself are always in motion. This is where predictive models come in to give you a much more accurate, forward-looking view of customer value.

Predictive CLV stops relying on simple averages and starts factoring in variables like churn risk and individual customer behaviors to forecast what a customer will be worth. Instead of just adding up past receipts, you’re asking a much more powerful question: "Based on what we know right now, what is this customer’s future potential?" Answering this is a game-changer for making smart, strategic decisions.

A Simple but Powerful Predictive Formula

One of the most practical predictive models zeroes in on two crucial metrics: Average Revenue Per User (ARPU) and Churn Rate. It's an absolute workhorse for subscription-based businesses, from SaaS platforms to e-commerce stores with recurring orders.

The formula itself is deceptively simple:

Predictive CLV = Average Revenue Per User (ARPU) / Churn Rate

Let's quickly unpack the two parts:

- ARPU: This is the average revenue you pocket from a single customer over a set period, usually a month or a year.

- Churn Rate: This is the percentage of customers who walk away during that same period. It’s the silent killer of growth, and this formula puts it right under the microscope.

This approach fundamentally ties customer value directly to retention. It shows, in black and white, how much your entire customer base is worth depends on your ability to keep them around.

Seeing the Predictive Model in Action

Let’s say you run a subscription box service. You dig into your numbers and find a few key things:

- Your monthly ARPU is $40.

- Your monthly Churn Rate is 5% (or 0.05).

When you plug these into the formula, you get an immediate, powerful insight:

CLV = $40 / 0.05 = $800

This tells you that, on average, every new subscriber you sign up is projected to be worth $800 over their entire relationship with your business. But the real magic happens when you start modeling the impact of small changes.

Imagine your customer success team rolls out a new onboarding campaign that successfully drops your monthly churn from 5% down to just 4%. What happens then?

New CLV = $40 / 0.04 = $1,000

That tiny, one-percent drop in churn just boosted your Customer Lifetime Value by a massive $200—a 25% increase. This is precisely why predictive modeling is so crucial. It puts a dollar figure on the impact of your retention efforts.

As data analytics and machine learning get more accessible, these models become even sharper. Modern predictive CLV can factor in individual churn probabilities and product usage patterns, leading to incredibly accurate forecasts. In fact, companies using these techniques have seen their forecast errors plummet by 30–40% compared to old-school methods. You can learn more about how data analytics tracks customer lifetime value to see just how deep this rabbit hole goes.

By adopting a predictive mindset, you’re no longer just reacting to what happened last quarter. You’re proactively shaping what happens next. You can spot customers who are likely to churn and step in to save them, or identify segments with the highest potential CLV and go find more people just like them.

Putting Your CLV Insights into Action

Running the numbers on your customer lifetime value is a great start, but it's just that—a start. The real magic happens when you take those insights out of the spreadsheet and apply them to your business strategy. This is where the data transforms into real-world, profitable decisions.

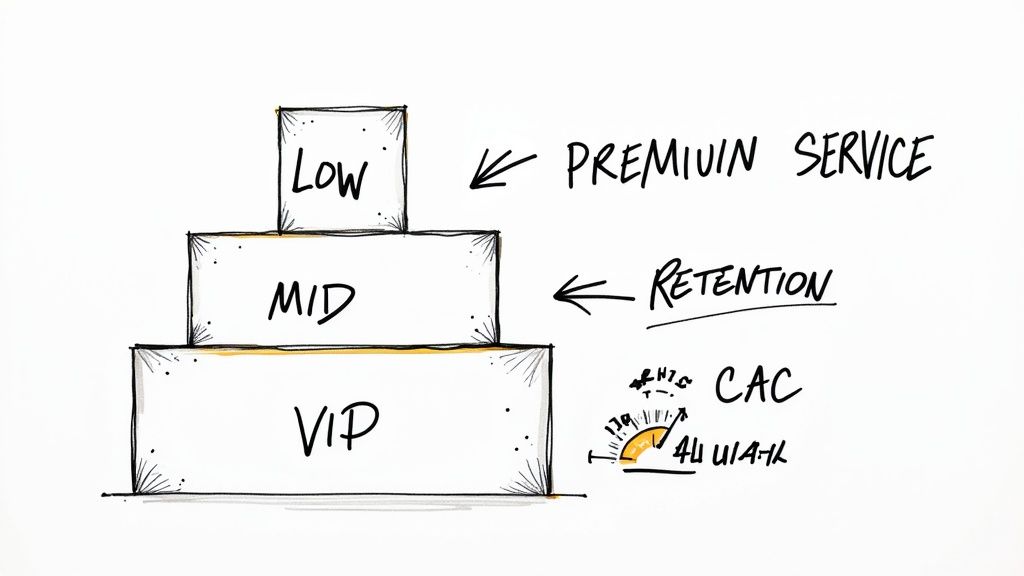

One of the most powerful things you can do right away is customer segmentation. Your CLV calculations make it crystal clear that not all customers are the same. You can now group your audience into distinct tiers—high, medium, and low value—and finally stop the one-size-fits-all approach. Your high-value segment, for example, often aligns with the classic 80/20 rule, where the top 20% of your customers might be generating 80% of your revenue.

These are your VIPs. It’s time to start treating them that way.

Fine-Tuning Your Marketing Spend

Your CLV figure is the secret weapon for optimizing your marketing budget. When you stack it up against your Customer Acquisition Cost (CAC), you get the crucial CLV-to-CAC ratio. This simple metric tells you, in no uncertain terms, whether you're bringing in new customers profitably. A healthy benchmark to aim for is 3:1 or higher. This means for every dollar you spend to acquire a customer, you get at least three dollars back over their lifetime.

If your ratio is dipping too low, it's a clear signal to make a change.

- Dig into channel performance: Are customers from Google Ads more valuable than those from TikTok? Find out which channels deliver the high-CLV customers and double down on what’s working.

- Sharpen your targeting: Take a close look at the traits of your best customers. Use that data to build lookalike audiences and go find more people just like them.

This kind of data-first thinking turns your marketing spend from a necessary expense into a smart investment.

Sharpening Your Retention Efforts

Knowing your CLV is also fundamental to improving your top customer retention strategies. It gives you a clear financial justification for investing in loyalty programs, dedicated support, or exclusive offers for your most valuable segments. Suddenly, going the extra mile to prevent a top-tier customer from churning isn't just good service—it's a sound business decision.

For a SaaS or subscription business, another helpful formula is LTV = Average Revenue Per User (ARPU) / Churn Rate. Let’s say your app has a monthly ARPU of $5 and a monthly churn rate of 30%. Your LTV would be about $16.67. But what if you could get that churn rate down to 20%? Your LTV shoots up to $25, a massive 50% increase. It’s a perfect illustration of how even small gains in retention can have a huge impact on your bottom line.

By applying your CLV insights, you move from simply measuring customer value to actively shaping it. You can build a more resilient business focused on nurturing profitable, long-term relationships.

Untangling Common Questions About Customer Lifetime Value

Even after you've got the formulas down, putting CLV into practice always brings up a few tricky questions. It's a metric that's simple on the surface but has a lot of nuance. Let's walk through some of the most common questions that pop up when teams start digging into their own numbers.

So, What's a "Good" CLV?

This is usually the first question on everyone's mind. The honest answer? It completely depends. There’s no magic number that works for everyone. A "good" CLV for a high-end software company selling enterprise deals is going to look completely different from a Shopify store selling coffee beans.

The real insight doesn't come from the dollar amount itself, but from how it stacks up against your Customer Acquisition Cost (CAC). This comparison gives you the CLV-to-CAC ratio, which is a far more powerful health check for your business.

As a rule of thumb, a healthy CLV-to-CAC ratio is 3:1. This means you're making three dollars back for every dollar you spend acquiring a customer. If you're at 1:1, you're essentially just breaking even on your marketing efforts.

How Often Should We Calculate CLV?

Timing is another practical hurdle. Should this be a weekly KPI, a monthly review, or an annual deep dive? The best cadence really hinges on your business model and the pace of your industry.

- For fast-moving businesses like e-commerce or mobile apps, I'd suggest calculating CLV quarterly, maybe even monthly. It helps you see the immediate impact of a new marketing campaign or a pricing shift.

- For companies with longer sales cycles, such as B2B SaaS or high-ticket consulting, running the numbers semi-annually or annually is usually plenty to spot meaningful trends without getting lost in the noise.

Ultimately, consistency is more important than the specific interval you choose. Pick a schedule and stick to it. That's how you'll spot trends over time and see if your strategies are actually moving the needle.

Sidestepping Common Calculation Mistakes

It's surprisingly easy to trip up when calculating CLV, and a few common errors can lead you to make some really poor decisions. Knowing these pitfalls ahead of time will save you a world of trouble.

One of the biggest mistakes I see is focusing only on revenue while completely ignoring costs. A "gross" CLV that doesn't account for what you spent to acquire and serve the customer is just a vanity metric. You always want to calculate a "net" CLV to get a true picture of profitability.

Another classic blunder is relying on a single, company-wide average. Your customer base isn't one big, uniform blob. You'll uncover much more valuable insights by calculating CLV for different segments—maybe by acquisition channel, the first product they bought, or even their location. A blended average hides all the good stuff.

Ready to slash your software costs and streamline your e-commerce operations? EcomEfficiency bundles over 50 premium AI, SEO, and ad-spy tools into one simple subscription. Stop juggling dozens of expensive tools and start saving up to 99% today. Explore the full toolkit and join our community of 1,000+ ambitious sellers.