how to find trending products: Uncover hot sellers with data

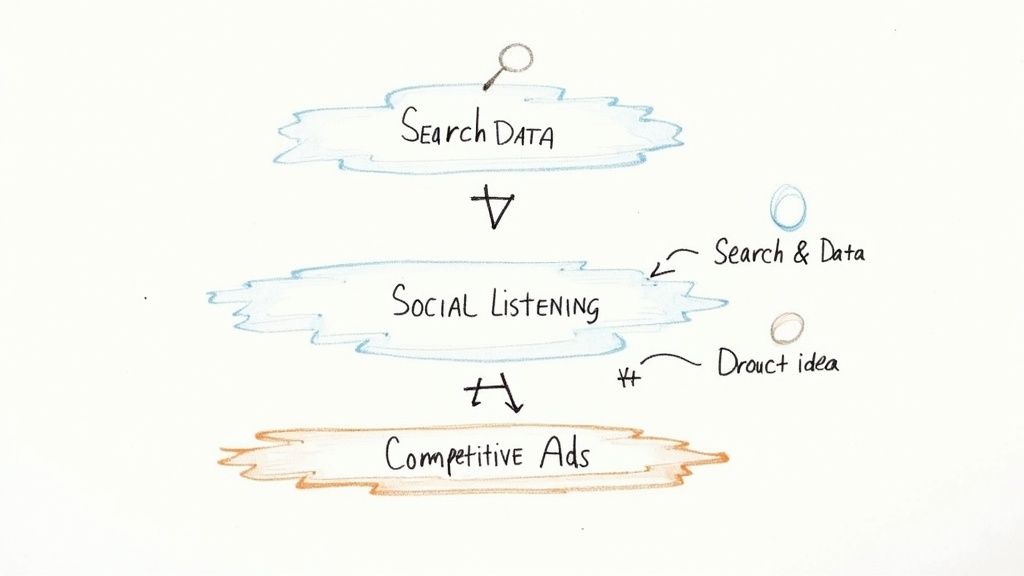

Finding a winning product isn't about guesswork or stumbling upon a magic bullet. It's about a systematic process that combines search data analysis, social media signal monitoring, and competitive ad intelligence.

Think of it this way: you're looking for proof. Proof that people are actively looking for a product, talking about it, and, most importantly, buying it. This method uses a mix of hard data and real-world social proof to validate an idea before you sink a dollar into inventory.

Your Blueprint for Finding Winning Products

The old way of finding products—relying on a single source like keyword volume—is a recipe for disaster. High search interest doesn't always equal high purchase intent. You might just be looking at a seasonal fad on its way out. A modern, blended approach is the only way to get the full picture and avoid those costly mistakes.

The key is to look at three core pillars of data that work together to tell a complete story. This visual guide breaks down how search trends, social signals, and ad spying connect.

Each of these steps acts as a filter, moving an idea from "interesting" to "market-proven." This strategy is your defense against chasing trends that have no real consumer demand behind them.

The Power of Combined Data Streams

When you integrate these different data sources, the market becomes much clearer. For example, raw search volume is a direct line into what customers want right now. It's one of the best starting points for uncovering shifts in consumer behavior.

Take the 'Gadgets and tech' category, which pulls in over 2,332,000 monthly searches for things like smartwatches and power banks. Or look at 'Health and wellness,' which sees 2,236,000 monthly searches for hot items like mushroom coffee and air purifiers. These aren't just numbers; they represent millions of people actively looking to buy. Hostinger provides more great insights into these kinds of consumer trends.

A successful product isn't just one that people are searching for. It's one that people are talking about on social media and that competitors are spending money to advertise. When all three signals align, you've likely found a winner.

To help you get started, here's a quick overview of the core product research methods we'll be diving into.

Core Product Research Methods at a Glance

This table breaks down the main strategies for product discovery, highlighting what each one offers.

| Method | Primary Data Source | Key Benefit | Example Tool |

|---|---|---|---|

| Search Trend Analysis | Search Engine Data (Google, Amazon) | Quantifies raw consumer interest and demand over time. | Google Trends, Semrush |

| Social Media Monitoring | Social Platforms (TikTok, Instagram, Reddit) | Uncovers what's buzzing and building organic hype. | TikTok Creative Center, Reddit |

| Competitive Ad Spying | Ad Libraries (Facebook, TikTok) & Spy Tools | Reveals what competitors are successfully selling right now. | EcomEfficiency, AdSpy |

| Marketplace Research | E-commerce Platforms (Amazon, Etsy) | Identifies best-sellers and gaps in existing markets. | Amazon Best Sellers, Etsy Trends |

Each of these methods provides a unique piece of the puzzle. When used together, they create a powerful framework for making data-backed decisions.

Building Your Discovery Mindset

Before we jump into the tools and tactics, it's critical to get into the right headspace. You need to think like a digital detective, piecing together clues from all over the web.

Here’s how to approach it:

- Be Curious and Observant: What are influencers constantly promoting? What problems are people complaining about on Reddit or in Facebook Groups? What ads keep showing up in your feed? Pay attention.

- Stay Data-Informed, Not Data-Blinded: The data should guide you, but it shouldn't overrule your gut. Sometimes the biggest wins are in new niches that the numbers haven't fully caught up to yet.

- Focus on Solving Problems: The products that truly take off almost always solve a nagging problem or fill a specific need. Always be on the lookout for pain points you can solve.

With this foundation in place, you’ll be ready to use the tools we're about to cover to turn raw data into a real, profitable e-commerce business.

Using SEO Tools to Spot Emerging Demand

Think of search engine data as a direct line into the collective mind of your customers. Every single search is a signal—a question, a need, a want. When you learn to tap into this data with SEO tools, you're not just playing with keywords; you're doing a bit of digital anthropology. You’re studying real human behavior to figure out what people are going to want to buy next.

While most people think of SEO tools for ranking websites, they are absolute goldmines for product research. Tools like the free Google Trends or more powerful platforms like Ahrefs and Semrush give you a window into historical search data. This is what lets you go beyond a simple keyword list and really see the popularity of a product over time—a critical skill for telling a sustainable trend from a flash-in-the-pan fad.

Reading the Signals in Search Volume

Your first move is to start treating search volume as a demand meter. A steady rise in searches for a term like 'mushroom coffee' tells you that curiosity is growing, and a potential market is forming. But one number in isolation means nothing. You need to zoom out and look at the trend over several years to get the full picture.

A sudden, dramatic spike followed by an equally dramatic crash is the classic sign of a fad. Remember fidget spinners? On the other hand, a product showing a steady upward climb over two to five years—maybe with some predictable seasonal peaks—points to a much more stable, long-term trend. This historical context is what keeps you from jumping on a product idea just as it's about to fizzle out.

This comparison from Google Trends shows exactly what I mean. You can see the difference between a fleeting fad and a real, sustainable trend in the search interest curves.

The graph makes it crystal clear. A fad's interest explodes and then vanishes, while a genuine trend demonstrates staying power and sustained growth.

From Keywords to Actionable Insights

Once you've spotted a promising trend, it's time to dig in. This is where you shift from just observing the data to actually validating your idea. You're hunting for "breakout" keywords—related search terms that are growing like crazy. These often reveal new angles, customer pain points, or even entire sub-niches within the main trend.

Mine the "Related Queries": In Google Trends, the "Related queries" box is your best friend. If you're looking into 'bakuchiol serum', you might find breakout queries like "bakuchiol vs retinol" or "best bakuchiol serum for sensitive skin." These tell you exactly how customers are thinking and what problems they're trying to solve.

Gauge the Competition: Tools like Ahrefs have a Keyword Difficulty (KD) score. Finding a high-volume keyword with a low KD score is like finding a hidden gem—it suggests an opportunity to get into a market that isn't totally saturated yet.

Check Regional Interest: Is the buzz for your product global, or is it concentrated in one area? Google Trends lets you filter by region, showing you where demand is hottest. This is invaluable for planning your launch marketing and shipping strategy.

The goal isn't just to find popular keywords. It's about understanding the intent and the momentum behind the searches. That's how you turn raw data into a real business advantage.

A perfect example of this in action is tracking the rapid growth of specific product searches over time. The term bakuchiol serum—a natural alternative to retinol—has exploded with a 733% increase in search volume over the last five years. In a different niche, searches for ADHD supplements have surged by an incredible 1,011%, signaling a massive shift in awareness around mental health. This kind of data helps you find untapped markets right before they go mainstream. You can learn more about identifying emerging product trends on ExplodingTopics.com.

By putting these techniques to work, your SEO tools become much more than just traffic-drivers. They become powerful market intelligence platforms that let you validate an idea, gauge its longevity, and get a feel for the competition—all before you invest a single dollar.

Using AI and Ad-Spy Tools to Find What’s Actually Selling

SEO tools are great for understanding what people are searching for, but that's only half the picture. Search volume doesn't always equal sales. This is where ad-spy and AI tools come in—they show you what people are actually buying. You get to see what successful brands are betting thousands of dollars on every single day.

Think of it as ethical spying. Platforms like AdSpy, Minea, or the ad-spy features built into the EcomEfficiency suite are like a giant, searchable library of ads running across Facebook, TikTok, and Instagram. Instead of guessing what might sell, you see what is selling right now, backed by real ad spend.

How to Decode Winning Ads

Jumping into an ad-spy tool for the first time can be a bit much. You're hit with a firehose of data. The trick is to know which filters to apply to cut through the noise and spot the ads that signal a real winner. You aren't just looking for any ad; you're hunting for ads with specific traits that scream profitability and potential to scale.

This goes way beyond just typing a product keyword into the search bar. You need to filter based on metrics that prove an ad is actually working.

Here are the filters I always start with:

- Long-Running Ads: If an ad has been active for 30 days or more, that’s a massive clue. Nobody burns cash on a campaign that isn't making them money. It’s a clear sign of a positive return on investment (ROI).

- High Engagement: Look for ads with serious social proof—we're talking thousands of likes, comments, and shares. This shows the product is hitting a nerve and getting people excited.

- Specific Ad Platforms: Planning to crush it on TikTok? Then filter for TikTok ads. What works on Facebook often falls flat with the faster-paced, younger audience on TikTok.

- Shopify Integration: Most legit e-commerce brands are built on Shopify. Filtering for ads that point to a Shopify store helps you weed out big-box retailers and focus on direct-to-consumer businesses like yours.

Combining these filters is your fastest path to a shortlist of products that have already been validated by someone else’s marketing budget.

Reverse-Engineering a Success Story

Once you’ve found a promising ad, the real detective work begins. The goal here is to reverse-engineer their entire sales funnel to figure out why it's working. This is how you move from finding products to understanding winning marketing angles.

Don't just fixate on the product. You need to analyze the entire experience, from the ad creative they used to the checkout page. Dig into their landing page. Is it a custom page built for just that one product? What kind of urgency tactics are they using, like countdown timers or low-stock warnings? Are they plastering customer reviews and user-generated content everywhere?

A great product is only one piece of the puzzle. A winning campaign is the right product, matched with killer ad copy, eye-catching creative, and a landing page that converts like crazy. Study all of it, and you're not just finding a product—you're getting a complete marketing blueprint.

For instance, say you find an ad for a portable blender that's been running for 60 days and has over 50,000 likes. You click through and land on a page screaming a 50% off "limited-time" offer, a bundle deal to get you to spend more, and dozens of video testimonials. That tells you so much more than "portable blenders are popular." It shows you a proven strategy for how to sell portable blenders.

Getting Ahead of the Curve with AI

The newest product research platforms are now using AI to do more than just spy on ads. AI can crunch massive amounts of data to spot patterns and predict what's about to blow up. These tools help you see around the corner, not just what's right in front of you.

Tools like Exploding Topics, which is part of the EcomEfficiency bundle, use AI to scan millions of searches, social media posts, and online articles. They identify products and topics in the earliest stages of their growth curve, giving you a chance to get in before the market is flooded.

Think about the difference here:

| Method | Data Source | Key Insight |

|---|---|---|

| Traditional Ad Spying | Active Ad Campaigns | Shows what is currently profitable and being scaled. |

| AI Trend Prediction | Search, Social & News Data | Predicts what will become profitable in the near future. |

The smartest approach is to use both. Use an AI-powered tool to find an emerging trend, then jump over to your ad-spy tool to see if anyone has already started running successful ads for products in that niche. This two-step process gives you the confidence that you’re betting on a trend with both future potential and proven, current demand.

Reading the Tea Leaves on Social Media and Marketplaces

While search data and ad performance give you the hard numbers, social media is where trends are actually born. Think of it as the digital pulse of consumer culture—it’s where you can see what people are getting excited about in real-time. If you learn to read these signals, you can spot products as they start to gain traction, long before they're saturated.

Social platforms aren't about search intent; they're about discovery. A single viral TikTok video can create millions of buyers for a product they’d never even heard of just minutes earlier. This is where you find the opportunities that SEO and ad-spy tools won't catch for weeks, maybe even months.

Decoding Viral Social Proof on TikTok and Instagram

Instagram is great, but TikTok has become a legitimate product-launching machine. Hashtags like #TikTokMadeMeBuyIt and #AmazonFinds aren't just clever tags; they’re live, breathing focus groups showcasing products with massive viral potential. Your job is to become a digital trend spotter in this environment.

Don't just scroll—analyze. Keep an eye out for videos featuring a specific product that are getting unusually high engagement, especially from everyday users, not just big-shot influencers. When you see multiple, unaffiliated creators posting about the same quirky kitchen gadget or that new skincare serum, you're witnessing an organic trend taking shape.

Here’s exactly what I look for:

- The Comment Section: What are people actually saying? Comments like "Where can I get this?!" or "OMG I just ordered one" are pure gold. That’s immediate buying intent, right there in the open.

- Video Stitches and Duets: Are other users creating their own content with the product? This is a huge sign that a trend is spreading organically from person to person.

- Sound Usage: On TikTok, viral products often get attached to a specific sound clip. If you track that sound, it can lead you to hundreds of other user-generated videos about the same exact item.

This kind of manual research is invaluable. Think about how products like the Mighty Patch for acne or the Stanley Quencher tumbler blew up. It all started with authentic user videos that snowballed into global trends.

Social media is modern word-of-mouth, but at a global scale. A single viral video can create more demand overnight than a six-figure ad campaign could in a month. You absolutely have to pay attention to what gets genuine user excitement.

Tapping into Niche Communities on Reddit

Moving away from the fast-paced world of TikTok, Reddit offers a totally different kind of insight. Its niche communities, known as subreddits, are treasure troves of brutally honest product discussions and recommendations. This is where you can find hyper-engaged enthusiasts talking about their problems, needs, and the products they absolutely swear by.

Subreddits like r/BuyItForLife, r/shutupandtakemymoney, and hobby-specific hubs like r/skincareaddiction or r/homegym are perfect listening posts. Look for threads where users are asking for product recommendations or sharing a recent purchase they're thrilled with. The upvotes and comments on these posts are a direct measure of community interest.

This isn't about chasing viral hits; it's about finding products that solve real problems for passionate groups of people. This approach often leads you to more evergreen products with incredibly loyal customer bases, not just fleeting fads.

Mining the Big Online Marketplaces

Finally, don't forget the free data that major e-commerce platforms hand you on a silver platter. Marketplaces like Amazon and Etsy are constantly curating lists of what's flying off their digital shelves, giving you a direct window into consumer behavior.

These lists are updated constantly—sometimes hourly—and provide a super accurate snapshot of what’s resonating with buyers right now.

- Amazon Best Sellers: This is the obvious one, showing the most popular products by sales, updated every hour. The trick is to drill down into the most specific sub-categories you can find to uncover niche winners.

- Amazon Movers & Shakers: This is where the real magic happens. It highlights products with the biggest jumps in sales rank over the last 24 hours. This is how you spot breakout products just as they start their climb.

- Etsy Trends: Etsy provides its own trend reports and a "Trending Now" section that's perfect for spotting rising stars in the handmade, craft, and personalized goods markets.

By keeping a regular eye on these social and marketplace signals, you can build a much richer, more complete picture of what to sell. It adds that crucial human context of what people are genuinely excited to talk about and buy, which is the perfect complement to the hard data you get from your other tools.

Validating Your Product Idea Before You Invest

Finding a product that feels like a winner is an incredible rush, but that feeling is only half the battle. The real secret to e-commerce success is validation—proving with cold, hard data that people will actually pay for what you want to sell.

Think of it as your financial safety net. Skipping this step is easily the most common and painful mistake I see new sellers make. You have to move past your gut instinct and confirm your product has a clear path to profitability before you sink a single dollar into inventory.

Dig Into Sales Growth to See What's Really Selling

One of the best ways to validate an idea is to look at real sales growth from major e-commerce platforms. We're not talking about search volume or social media hype; we're talking about where customers are actually spending their money.

Analyzing year-over-year sales growth gives you a raw, unfiltered look at what people truly want and helps you get ahead of massive demand surges.

For instance, recent data shows some wild spikes that paint a clear picture of shifting markets. Sports trading cards exploded by 1,786%, while printable fabric shot up 1,608%. At the same time, instant coffee saw a 1,339% jump, showing a huge demand for convenience. Other booming categories like digestive supplements (+1,075%) and energy drinks (+945%) point to a major consumer focus on health and wellness. You can dig into more of these product trends on Shopify.com.

These numbers aren't just small bumps; they're giant signposts pointing directly to where the money is flowing. When you see that kind of growth, you can be confident the trend has serious commercial power.

Check Supplier Data to Make Sure the Numbers Work

Okay, so you've confirmed people are buying the product. Great. Now, can you actually make money selling it? This is where you need to put on your business hat and dive into supplier marketplaces like Alibaba.

Your mission here is twofold: you need to gauge manufacturing interest and figure out your potential profit margin.

- Manufacturing Interest: Start by searching for your product. If you see a ton of different manufacturers making the item and its variations, that’s a fantastic sign. It means there's a stable supply chain and you’ll likely find competitive pricing.

- Unit Cost vs. Retail Price: Look at the bulk pricing for different order sizes. Next, go see what similar products are selling for on Amazon or other Shopify stores. The difference between the supplier's price and the going retail rate is your potential gross margin.

Don't just chase the lowest price. A slightly more expensive supplier who offers better quality, faster shipping, or customization options is often the smarter play. Profit isn't just about cost; it's about the total value you can offer your customers.

Let's say you find a supplier for a trendy portable blender at $10 a pop for an order of 500. A quick search shows competitors are selling similar ones for $40-$50. Right away, you know there’s a healthy margin to work with for marketing, shipping, and all the other costs of doing business.

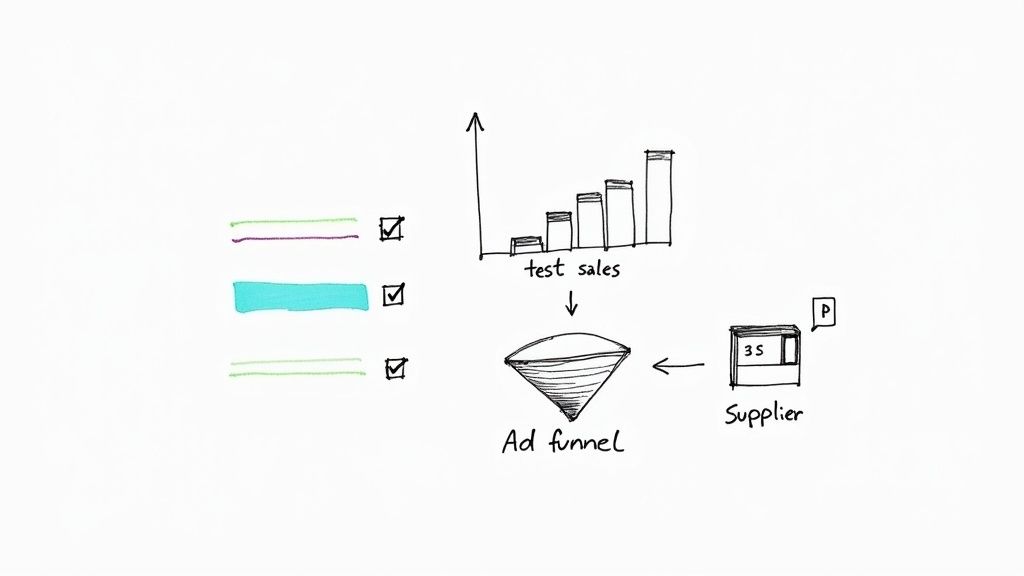

Test the Waters With a Small Ad Campaign

Ultimately, the best validation comes from real people pulling out their wallets. Before you go all-in on a huge inventory order, running a small test campaign with paid ads is one of the smartest things you can do. It's your chance to measure actual customer interest with very little risk.

First, set up a simple landing page—it can even be a "coming soon" page. You don't need the product on hand yet; a pre-order campaign works perfectly. Then, drive a small amount of targeted traffic to that page using Facebook or TikTok ads.

Pay close attention to these three metrics:

- Click-Through Rate (CTR): Is your ad creative grabbing attention? Are people curious enough to click?

- Add-to-Carts or Pre-Orders: This is the big one. Are people showing they actually intend to buy?

- Cost Per Acquisition (CPA): How much are you spending in ads to get one pre-order or email signup? Is that number sustainable given your projected profit?

If your test campaign brings in pre-orders at a profitable CPA, you have solid proof that you've got a winner. If not? You just saved yourself a ton of money and learned a valuable lesson you can apply to your next big idea.

Before you commit, it's wise to run through a final checklist to ensure you've covered all your bases. The goal is to move forward with confidence, backed by data, not just hope.

Product Validation Checklist

This simple table provides a structured way to think through the validation process, ensuring you're asking the right questions and using the right tools at each stage.

| Validation Step | Key Question to Answer | Primary Tool/Method |

|---|---|---|

| Confirm Market Demand | Are people actively buying this type of product right now? | EcomEfficiency, Shopify Trending Products, Google Trends |

| Assess Competition | Who are my main competitors, and can I realistically compete with them? | Ad-spy tools (like AdSpy), Amazon Best Sellers, competitor analysis |

| Analyze Profitability | Is there enough margin between the supplier cost and the retail price to be profitable? | Alibaba, AliExpress, competitor pricing research |

| Test Customer Intent | Will real customers show genuine interest in buying my specific product? | Facebook/TikTok ad tests, pre-order landing pages, customer surveys |

| Evaluate Long-Term Viability | Is this a fleeting trend or a product with lasting potential and a solid supply chain? | Market research reports, Google Trends (5-year view), supplier feedback |

By methodically working through these steps, you replace guesswork with a clear, data-driven strategy. This process doesn't just reduce risk; it dramatically increases your odds of launching a successful and profitable e-commerce brand.

Got Questions About Product Research? We’ve Got Answers.

Once you start digging into the e-commerce world, you'll find the same questions popping up again and again. Getting a handle on these fundamentals can be the difference between confidently picking a winner and just feeling lost in a sea of data.

Let's tackle some of the most common questions that come up when you move from theory to actually finding products to sell.

How Often Should I Be Looking for New Products?

Product research isn't a "one-and-done" task you tick off a list. Think of it as an ongoing process, a vital pulse check for your business. For an established store, setting aside a few hours every week to see what's happening in the market is a solid habit to build.

Trends, especially the ones that blow up on social media, can appear and vanish in the blink of an eye. If you're consistently keeping an eye on things with tools like Google Trends, ad-spy platforms, and social media, you can catch these waves early. This proactive approach lets you adapt your strategy long before a market gets completely flooded.

Think of product research like checking the weather. You wouldn't plan a week-long beach trip based on a single sunny day. You keep an eye on the forecast to make smart decisions. The same logic applies to your store.

What's the Real Difference Between a Trend and a Fad?

This is probably the most important distinction you can learn as a product researcher. A fad is like a firework—it explodes onto the scene with a ton of excitement and then fades away just as fast. Remember fidget spinners? That's a textbook fad.

A trend, on the other hand, has staying power. It shows steady, sustainable growth over several months, or even years. To tell them apart, your best friend is historical data. Pop the product idea into a tool like Google Trends and look at the graph.

- Fad Signal: You'll see a massive, sharp spike followed by an equally dramatic crash back to nothing.

- Trend Signal: You'll see a consistent, upward climb over a long period of time.

Trends are almost always tied to bigger shifts in culture or lifestyle—think of the demand for home office gear or the non-stop interest in health and wellness products. Fads are just novelties. Building your business on a trend is a strategy; betting on a fad is a gamble.

Can I Actually Find Good Products if I'm on a Tight Budget?

Absolutely. While premium tools are fantastic, many of the most powerful research methods won't cost you a penny. If you're willing to put in the legwork, you can uncover amazing insights for free.

Start by mastering the resources that are available to everyone. You can dive into Google Trends to check search history, hang out in niche subreddits to see what people are complaining about (and what they wish they could buy), and watch viral TikTok hashtags to see what's grabbing everyone's attention.

Even Amazon gives away gold for free. Their “Best Sellers” and “Movers & Shakers” lists are public and updated constantly. Use these free methods to build a solid shortlist of product ideas. Once you have a few top contenders, you can always grab a one-month subscription to a tool bundle like EcomEfficiency to do that final, deep-dive validation.

How Do I Know if a Market is Just Too Saturated?

Saturation can feel like a big red stop sign, but it doesn't always have to be a deal-breaker. You just need to know what you're looking for. First, use an SEO tool to check the keyword difficulty for your main product terms. A high score means you're up against some heavy hitters for organic search traffic.

Next, open up an ad-spy tool. Are you seeing dozens of different advertisers running ads for the same product? Lots of high-engagement, long-running campaigns often mean a market is competitive, but it also signals that it's very profitable.

Even in a crowded market, there's always room to create your own space. Look for a way to be different. You can win with a unique brand angle, a higher-quality product, or by targeting a specific sub-niche that the bigger players are ignoring.

Tired of juggling a dozen expensive subscriptions? With EcomEfficiency, you get access to 50+ premium AI, SEO, and ad-spy tools in one affordable plan. Discover winning products, analyze your competition, and create stunning marketing content—all for up to 99% less. Start your journey with EcomEfficiency today.